First of all, you may be wondering what are the CRB & CRSB and what is the difference between these and the CERB.

What is the CRB?

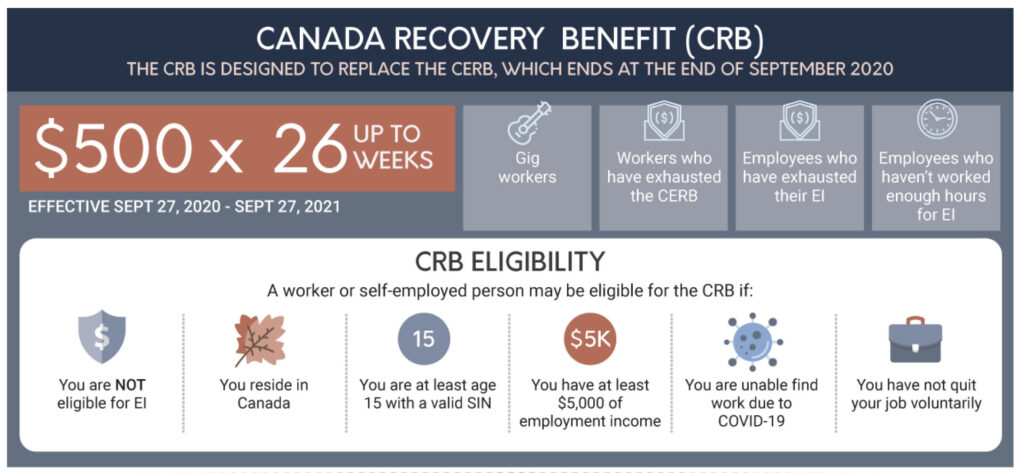

Simply put, the CRB is designed to replace the CERB, which ended in September 2020. This benefit provides support to those who are still affected by COVID-19 and are NOT entitled to EI benefits. If you are eligible for the CRB you can received $1000 ($900 after taxes are withheld) for a 2 week period . This is welcome news to the many Canadians who still find themselves in financial hardships due to closures and illness.

Eligibility criteria:

The following are some of the eligibilty for CRB benefits, please see the Canada Revenue Website for the full list of requirements and how to apply:

- During the period you’re applying for: – you were not working for reasons related to COVID-19 or you had a 50% reduction in your average weekly income compared to the previous year due to COVID-19

- You did not apply for or receive any of the following: –

» Canada Recovery Sickness Benefit (CRSB)

» Canada Recovery Caregiving Benefit (CRCB)

» Short-term disability benefits

» Workers’ compensation benefits

» Employment Insurance (EI) benefits

» Québec Parental Insurance Plan (QPIP) benefits - You have not quit your job or reduced your hours voluntarily on or after September 27, 2020, unless it was reasonable to do so

- You have not turned down reasonable work during the 2-week period you’re applying for

- You were not eligible for EI benefits

To keep up benefits:

- You must re-apply every 2 weeks – The CRB does not renew automatically. To keep getting your payments, you must re-apply after each period, up to a maximum of 13 periods.

- Make sure you are still eligible – You must continue to meet all the CRB eligibility criteria to keep receiving the benefit. Check that you’re still eligible every time you re-apply at Eligibility Criteria

- Continue to look for work – The CRB gives support to those who are unable to work or have reduced income due to COVID-19. You must be looking for work to be eligible.

- How to re-apply – You may only apply after the 2-week period you are applying for has ended. The application process is the same every time.

What if I have no paid sick days at work? How will I take time off if a family member or myself becomes ill?

What is the CRSB?

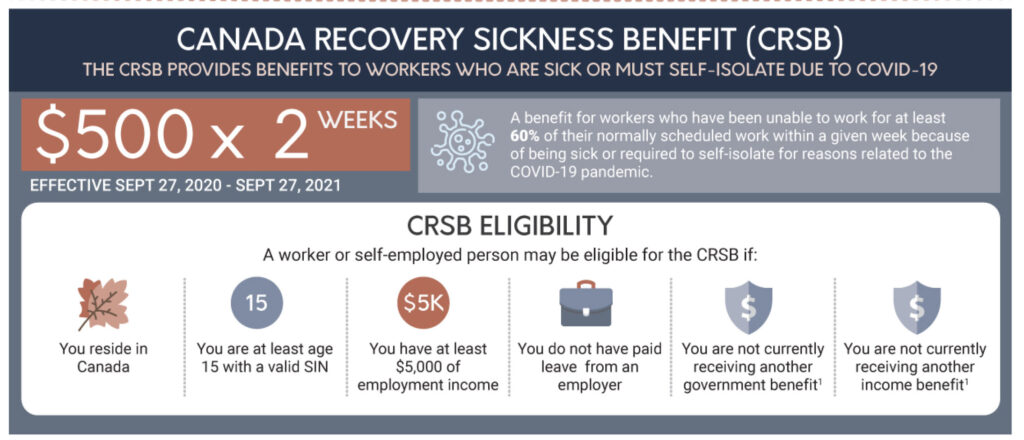

The CRSB provides benefits to workers who are sick or must self-isolate due to COVID-19. This benefit is designed to replace income for those who have been unable to work for at least 60% of their normally scheduled work within a week. The Canada Recovery Sickness Benefit (CRSB) provides a payment of $500 (before taxes withheld) for each 1-week period you apply for. After the CRA withholds 10% tax at source, the actual payment you get is $450 per 1-week period. Your payment amount will be the same for each period you’ve applied for, even if you worked for part of the week. To be eligible, you must have missed more than 50% of your work week.

If you’re eligible, you may apply up to a maximum of 2 weeks between September 27, 2020 and September 25, 2021.

Eligibility criteria:

You are unable to work at least 50% of your scheduled work week because you’re self-isolating for one of the following reasons:

- You are sick with COVID-19 or may have COVID-19 – Advised by your employer, a medical practitioner, a nurse practitioner, a person in authority, the government, your public health authority

- You are advised to self-isolate due to COVID-19 – Advised a medical practitioner, a nurse practitioner, a person in authority, the government, your public health authority

- You have an underlying health condition that puts you at greater risk of getting COVID-19.

- You did not apply for or receive any of the following for the same period:

» Canada Recovery Benefit (CRB)

» Canada Recovery Caregiving Benefit (CRCB)

» Short-term disability benefits

» Workers’ compensation benefits

» Employment Insurance (EI) benefits

» Québec Parental Insurance Plan (QPIP) benefits

For full eligibility requirements please visit: Government of Canada CRSB Benefit Page

It is important that all recipients of these benefits understand that the tax that is taken off is minimal at that in many cases further taxes will be required when you file your taxes for 2020.

This information has been pulled from the Government of Canada website, for full up to date information, please visit their website is more information at canada.ca/en/department-finance/economic-response-plan.html.

Share This Article

Choose Your Platform: Facebook Twitter Google Plus Linkedin